- Founder vs Finance

- Posts

- Funding Benchmarks for Early-Stage Startups

Funding Benchmarks for Early-Stage Startups

Milestones, Metrics, Multiples and Valuations for Early-Stage Startups to secure the next funding round.

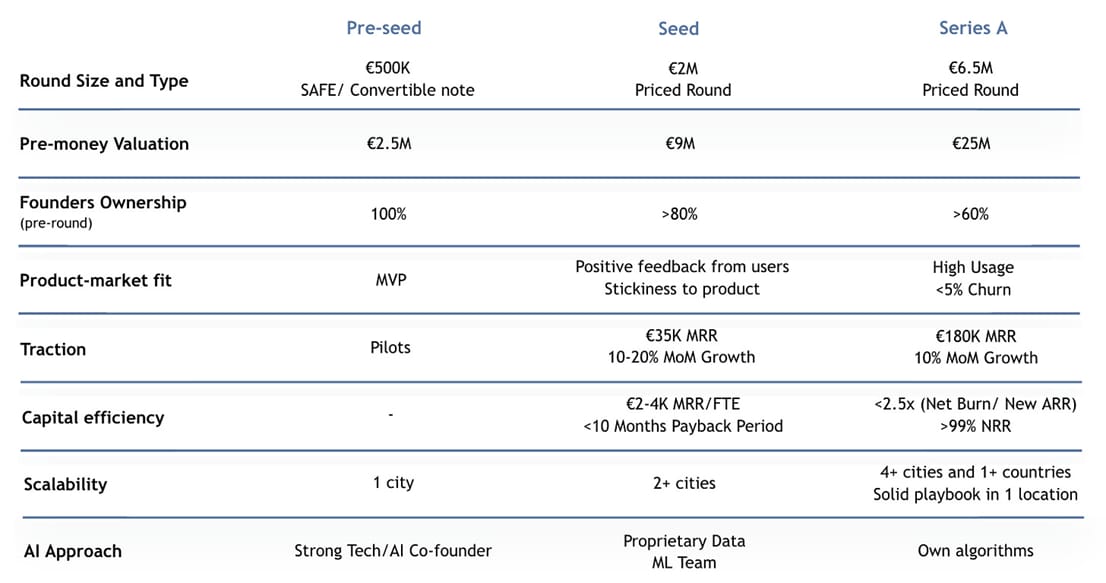

There’s not an exact path or route to follow when you are an entrepreneur, but there are certain ballparks estimates that I’ve seen at the early stages. When I consider a new investment opportunity, there are factors that I care more (or less) about.

What milestones does a B2B SaaS need to raise an early-stage round?

Please note that these figures represent the average of 30+ Spanish deals that I have analyzed recently as an investor. The data encompasses a wide variety of entrepreneurs, from seasoned and international founders based in Spain to 20 year-old entrepreneurs, so there is a broad range between metrics—these figures are merely averages.

Let’s break down the elements in the chart and discuss their relevance:

💰Round sizes, type, valuations and ownership:

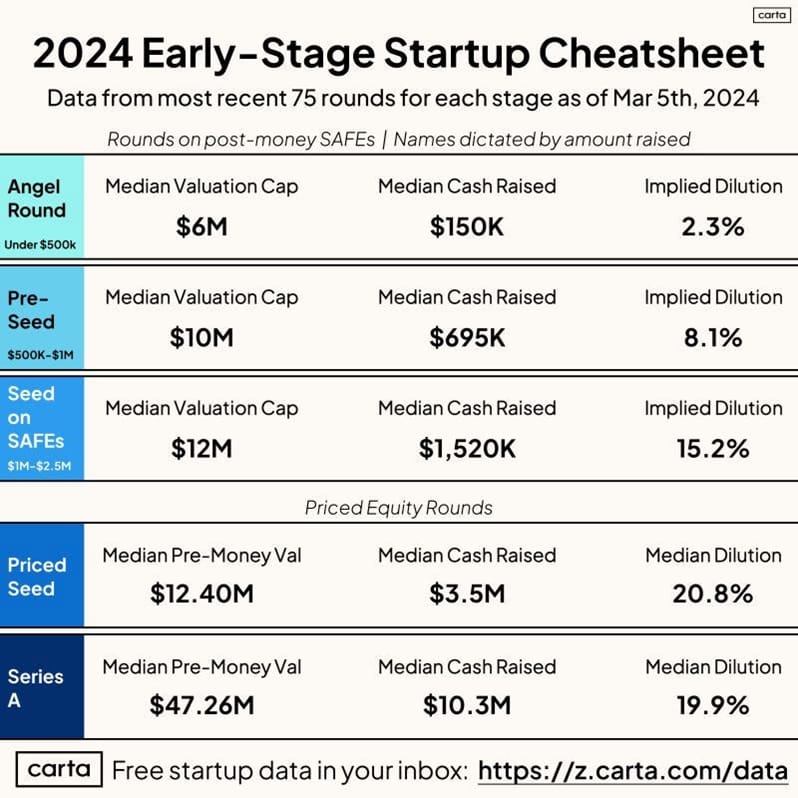

Startups backed by international investors often secure larger funding amounts at higher valuations. Spanish valuations and rounds are on the low side of the ranges, probably due to the lack of international investors in the initial stages.

In pre-seed, it is common to see SAFEs/Convertible Notes, as these can be executed faster than priced rounds. You can sign them with investors as you go, without needing all investors to commit simultaneously.

In some cases, I have seen accelerators/advisors taking significant ownership stakes at the pre-seed stage, which may eventually be viewed as a red flag by VCs.

▶️ Product-market Fit

Demonstrating product-market fit validates that the startup has a clear understanding of its target audience and their pain points. This evidence suggests that the startup has reduced the risk of failure or market rejection, and investors are more likely to support ventures that have a proven demand for their product or service.

While product-market fit is often qualitative, there are several metrics that can help you quantify and prove this alignment: low CAC, high usage, customer retention, etc.

📈Traction

Investors are increasingly looking for startups with the capability to make money from day zero, even if it's through a pilot. One of the most critical metrics in early stages is month-over-month (MoM) growth, which indicates market traction and adoption. Demonstrating rapid scaling, such as growing over 3x year-over-year (YoY), is crucial to maintaining investors' attention.

In later stages, maintaining high growth rates and revenue, alongside promising cohort data, will make your company appealing to VCs.

🧠Capital Efficiency

Unlike in the past, where rapid expenditure might have been seen as a sign of growth, today's investors focus on startups’ ability to maximize returns on every dollar invested. Leveraging AI-powered solutions to streamline processes, optimize workflows, and identify areas for improvement has become important to enhance operational efficiency and resource allocation.

The Burn Multiple is a capital efficiency metric that compares how much ARR is added with how much cash is spent in a given period. It measures how many dollars a company burns to create $1 of ARR.

🧗Scalability

It is key to understand the ability of a company to handle an increasing workload or market demand without compromising performance. It's about building systems, processes, and infrastructure that can seamlessly expand as the business grows.

🖥️AI Approach

Founders should prioritize an AI-centric approach and team. It ensures robust technology aligned with the business vision, enabling faster development of AI-driven products. Possessing proprietary data and a dedicated ML team empowers startups to extract valuable insights and create unique value propositions, fostering flexibility, scalability and sustainable growth.

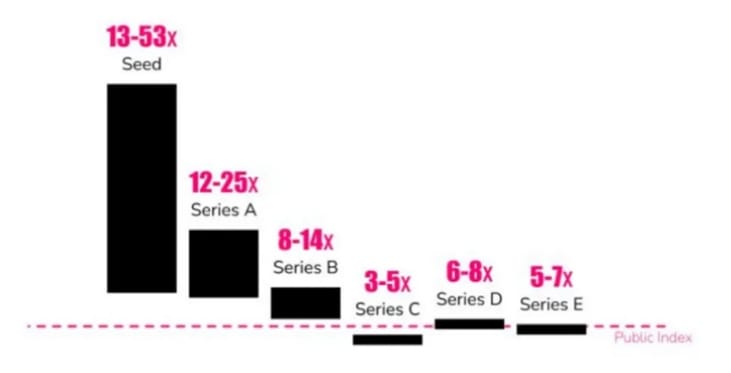

Ultimately, SaaS companies reaching IPO end up trading at standard public company ARR multiples, regardless of initial private valuations. Currently, this averages around 6-7x ARR at IPO.

SaaS Multiples

In the earlier stages, ARR multiples can be seen as inflated. This can be justified by their potential for higher growth compared to public SaaS companies, as well as being viewed more as a bet in the future rather than the present.

One significant takeaway is that when international VCs participate in an early-stage round, there is typically a boost in the round's size and valuation, yet this increase does not consistently correspond with higher metrics.

VC investors want to put their money on stellar teams operating in big markets, with conviction that there’s 100M+ ARR potential.

Reply